Going Global: The Challenges of Selling in Multiple Markets, Part 4

Contents

The Opportunities Abroad

Coordination Is Key

Direct vs. Indirect Sales

A Complex New World Order

Strategize Before You Globalize

Medical device manufacturers looking for rapid growth are looking outside the United States. And it is little surprise why. While in the U.S. market, competition is fierce and cost-containment has driven down margins, foreign markets are still relatively untapped and underserved. In fact, the latest figures available from the Health Industry Manufacturer's Association (HIMA) show exports of U.S. medical devices growing by 8.7% in 1999, handily outpacing growth in domestic consumption.

Going global is not a fail-safe proposition, however. Many a device manufacturer has learned the hard way that what sells in the U.S. does not necessarily sell abroad. One of the most common mistakes is to view international sales simply as an "extension" of domestic operations.

According to Richard Smith, vice president of International Sales and Marketing at Ohmeda Medical, "The one strategy that will guarantee failure is to approach international markets as an incremental opportunity. To be successful in the international arena is to be dedicated to investing in your desired markets."

In this article, we examine some of the challenges of selling medical devices in multiple markets with a look at how to overcome obstacles in the areas of marketing, sales, and distribution.

This is the last in a four-part series. Part one examined other aspects of selling in multiple markets, including organizational challenges; part two discussed pitfalls related to regulatory affairs and translation management; and part three looked at the questions surrounding package labeling for international markets.

The Opportunities Abroad (Back to Top)

These days, a successful product launch requires expensive marketing campaigns, far-reaching distribution channels, and massive R&D efforts to develop product extensions. With so much invested in each product, manufacturers must achieve maximum return; something only a world market can offer.

Particularly for smaller companies, where any given product can make or break a fiscal year, international expansion presents a number of important advantages:

- Faster growth opportunities—Increased demand for U.S. medical equipment and supplies abroad is a significant factor in the sector's worldwide growth. In addition, many overseas markets are less mature than the U.S. market and offer low barriers to entry.

- Access to distribution channels—Device manufacturers often are able to partner with ambitious, well-established local distributors. These distributors look for new technologies to build their business—and the device manufacturer's as well.

- Foreign markets as incubators—Overseas markets can serve as valuable testing grounds for new devices before such products are exposed to the demands and scrutiny of U.S. customers. Compared to the U.S., some markets also display higher rates of specific diseases (e.g., diabetes), offering sales and clinical-trial opportunities.

Coordination Is Key (Back to Top)

Without a well-executed strategy, global expansion can be a very frustrating experience. It is critical that international marketing and sales activities be coordinated with the actions of other departments. For instance, a marketing department's desire to move into a new country needs to be coordinated with product development, finance, and regulatory affairs.

A few issues to be aware of:

- Manufacturers must be very careful about what they write in labeling their products, because many countries consider labeling to be advertising. Therefore, manufacturers must carefully study the advertising rules in force in each country as well as the Advertising, Labeling, and Distribution of Medicinal Product Directives of the European Union before they design the labeling of their products.

- Privacy rules often differ from country to country. Many European countries, in particular, have stringent rules regarding the collection and dissemination of customer and patient data. The Information Systems group will need to modify patient and customer databases for each country.

- Many countries do not allow comparative advertising. Although permissible in the U.S. for the last 30 years, in Germany, for instance, an advertisement cannot say "brand x is better than brand y".

- When selling to multiple markets, packaging and labeling should be "localized" for each market: colors, paper format, and overall designs should be custom-tailored to each market so as to avoid the "insensitive U.S. bully" image. However, the desire for market-specific packaging must be balanced with company-wide branding and image concerns. Should the German package really look and feel different from the Japanese or the U.S. package?

- Companies may decide to centralize manufacturing in the U.S. and ship worldwide from there. Alternatively, the company may build regional manufacturing and/or distribution centers. Supplying global markets with medical devices requires a global manufacturing and distribution strategy that involves upper management and a thorough financial analysis.

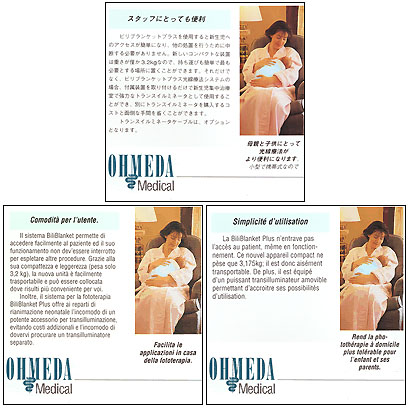

Three versions of Ohmeda's product labeling, localized for each country.

Direct vs. Indirect Sales (Back to Top)

The choice of an appropriate overseas distribution strategy is of critical importance to medical device companies. Profits can suffer—or disappear altogether—when the wrong choice is made.

In-Country Offices

At first glance, direct distribution through one or more offices in a particular country may seem like the most attractive option. This strategy provides greater control over pricing, sales policies, staffing, inventories, as well as a closer relationship with customers.

However, Ohmeda Medical's Smith points out that "an in-country office is very costly and the margins must be there to support the business." Only firms willing to invest significant money and resources into a market should contemplate this approach. Issues like staffing, training, and understanding local customs, laws, and languages can loom as large headaches and expenses.

Third-Party Distributors

As an alternative to establishing and maintaining a physical presence, U.S. device manufacturers can team up with local distributors. The main advantage is flexibility: by teaming-up with distributors, a device company can enter markets more quickly.

The same criteria for choosing a U.S. distributor apply to the selection of an overseas distributor. Look for compatible product lines, a strong track record, access to decision-makers, an energetic, "hungry" sales force, and, importantly, trust. According to Smith, "in most distributor relationships, you are relying on the distributor for decisions that affect your knowledge of the market as well as your brand image."

When selected properly, the distributor will have strong customer relationships with appropriate end-users. This will allow the distributors to seamlessly integrate a new product line.

A Complex New World Order (Back to Top)

Selection of an appropriate channel is only part of the overall distribution strategy. Medical device companies also have to determine the right mix of product to sell through this channel.

It used to be that product categories mirrored a device company's view of the world: domestic versus international. Nowadays, many companies find that these two categories are no longer sufficient.

Julieann Thornton, Supervisor, Package Labeling at Guidant Vascular Intervention, notes that global sales efforts have led to a proliferation of finished-good numbers (FGNs). Products now fall into four categories:

- Worldwide distribution (all countries)

- Domestic (U.S. only)

- International (excludes U.S.)

- Country-specific (e.g., Germany only)

Guidant Vascular Intervention is considering further refinements still: based on the current trend of different countries to standardize on common regulatory guidelines, products may soon be categorized as "FDA approved" (i.e., U.S., Mexico, Canada, Taiwan), "EU approved" (i.e., Europe, Australia, Mercosur), and country-specific.

There are good reasons why this trend toward multiplying FGNs is so popular: Additional categories make it easy to track different product versions and facilitate a central manufacturing approach. However, adding FGNs is a very expensive undertaking and additional costs resulting from warehousing, inventory management, labeling, obsolescence, and custom procedures can be substantial. As a device manufacturer expands into more and more global markets, it must keep a close eye on return on investment.

Strategize Before You Globalize (Back to Top)

Most major U.S. medical device companies now view foreign markets in the same light as domestic markets. In fact, on average, most device companies derive approximately 30-45% of revenue from international sales. While there are many challenges and hurdles to overcome, this percentage is only certain to increase as medical device manufacturers step up and fine-tune their global marketing and sales efforts.

This is the last in a four-part series. Click on these links to read part one, part two, or part three.

Andres Heuberger is president of Foreignexchange Translations, Inc., One Richmond Square, Providence, RI 02906. Tel: 401-454-0787. Fax: 401-454-0789. Email: andresh@fxtrans.com. Website: http://www.medicaltranslation.com.